- PPL: People Places Lives

- News

- Managed Accounts Pitfall?

Managed Accounts Pitfall?

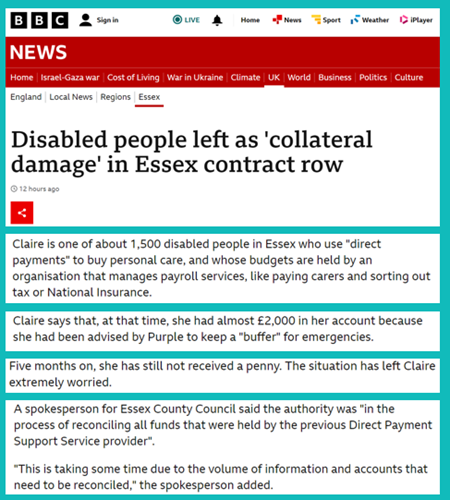

Although there is lots of it, good news from the world of direct payments doesn't get much attention. So when my newsfeed started alerting me to the news story that the BBC was carrying, I sighed inside. I was expecting a Daily Mail-type exposé of someone buying something racy with 'public funds'. However, it was something far more concerning...

I shan't dwell on the details, but I think the story highlights an issue that the health and social sector needs to take more seriously as the move towards personalised care models continues and the sums of money at stake increase.

The first thing to say about this story is that there is no suggestion of any deliberate wrongdoing. PPL have had past interactions with all three parties mentioned in the story, and it is fair to say that all of the people we have encountered have always been as committed to helping people with their direct payment as you would hope and expect.

However, the reality is that direct payments are sometimes 'messy' and things can quickly get out of control. The best case is that the reconciliation gets completed, the money is there and it gets transferred to the new provider. Its still not great, as Claire and others have had a distressing experience, but at least there is no direct financial loss. The worst case is that someone is going to end up footing the bill...

How to stop it happening?

This one ended up in the news, but we've seen similar scenarios several times now. We have previously suggested that providers of ‘managed accounts’ and ‘third party budgets’ fall within the scope of the Payment Services Directive and should be licenced by the Financial Conduct Authority (FCA).

This story reinforces our position, as the scenario that has played out simply could not happen under the watch of the FCA:

- One of the requirements of being licenced by the FCA is that providers must perform a daily reconciliation of the funds they hold on behalf of every individual to that day's bank statement.

- The FCA requires that an external third party completes an annual 'safeguarding audit' to check that this is happening.

- Any anomalies must be reported promptly to the FCA, who will take action if required.

Why does this matter?

We estimate that there are between 30,000 and 60,000 ‘managed accounts’ and ‘third party budgets’ in England. If these are funded on a 4-weekly cycle and the average person is holding 4 weeks of contingency funds, then Direct Payments Support Service organisations are 'sitting on' anywhere between £30m and £200m of client funds at any given time.

The published annual report of one leading DPSS organisation shows that it was holding client funds (which includes but is not limited to managed accounts) of £58.7m on 31 March 2023. They are not licenced by the FCA.

Of course, those that hold funds via PPL's Virtual Wallet solution or via pre-paid card solutions can rest assured that daily reconciliations are being performed so there is no risk of a situation like this occurring.

Action - what should I do?

We would advise Local Authorities and Integrated Care Boards to ask their DPSS organisation for a reconciliation of all managed account balances held by them to a supporting bank statement. If they can't produce it within 24 hours, then you are at risk of being the next headline.

If this area interests you, you may want to take a look at our Why FCA matters article.

To discuss any of the matters raised in this article, please get in touch with David Bowes via dbowes@peopleplaceslives.co.uk or 07932 678845.